Sustainably caught skipjack tuna is offloaded in the Maldives.

Ships that ‘go dark’ are suspected of exploiting overfished tropical tuna stocks.

Photograph: Paul Hilton/Greenpeace

Ships that ‘go dark’ are suspected of exploiting overfished tropical tuna stocks.

Photograph: Paul Hilton/Greenpeace

From The Guardian by Keren McVeigh

Complaint says switching off tracking devices should raise ‘red flags’ with insurers, as it could be covering illegal fishing activity and puts crew’s lives at risk

When it comes to illegal fishing, London’s ancient business of ship insurance may not get much attention.

But according to a new complaint, the UK capital’s insurance industry is partly to blame when fishing vessels “go dark” at sea by turning off their mandatory satellite tracking equipment.

In a filing to City of London watchdogs, the ocean conservation charity Blue Marine Foundation has argued that EU-flagged vessels operating in the Indian Ocean that go dark are in likely breach of international, flag state and coastal state law, and that the UK insurance industry is “enabling” them by continuing to provide cover, thereby putting seafarers’ lives at risk.

The complaint, made to the Financial Conduct Authority and the Prudential Regulatory Authority, is based on analysis of what the charity calls “highly inconsistent” use of AIS (Automatic Identification Systems) by 46 EU fishing vessels over four years, mostly owned by Spanish and French companies.

It pointed the finger at three British firms – the Britannia Steam Ship Insurance Association Ltd, British Marine and MS Amlin – for insuring the vessels despite the AIS problems.

A ship’s AIS tracks its location, acting as a safety and navigational aid that, in part, helps captains avoid collisions at sea.

Turning off this system for long periods puts the lives of crew at risk and raises transparency concerns, the charity said.

It said that while there is no suggestion the vessels studied were engaged in illegal activities, switching off AIS should raise “red flags” with insurers, as it means potential illegal or unauthorised activity, such as fishing in unauthorised areas, could be taking place.

One insurer, British Marine, told the Guardian the EU-owned vessels identified by the charity have been placed on its “watch list” because of the findings.

The complaint is based on peer-reviewed legal research by Blue Marine, published last month.

The paper, the Illegality of Fishing Vessels Going Dark and Methods of Deterrence, concluded that insurers have a duty to curb illegal behaviour, and suggested insurers enable vessels to “go dark” as a result of weak due diligence.

Priyal Bunwaree, senior legal counsel at Blue Marine and research author, said: “The legal analysis shows that EU-owned vessels operating in the Indian Ocean and ‘going dark’ could be in breach of AIS laws, and that UK insurers are likely enabling such behaviour by providing them with the cover they need to operate.”

Legal guidance from Lloyds and the Office of Financial Sanctions Implementation (OFSI) states that gaps in AIS transmission are a “red flag” for insurers, Bunwaree said.

The OFSI guidance recognises legitimate reasons for switching off the AIS, but it also states: “AIS is often intentionally disabled by vessels that seek to obfuscate their whereabouts, and is often practised by vessels seeking to conduct illicit trade.”

Jess Rattle, head of investigations at Blue Marine, said: “We are calling on insurers to look into the AIS histories of vessels and carry out thorough risk assessments before deciding to insure them, and to insert clauses into their contracts that mandate the responsible and consistent use of AIS.”

These risk assessments are vital for crew safety and the transparency of fishing fleets operating “out of sight” and exploiting tropical tuna stocks, of which two out of three are currently overfished in the Indian Ocean, she said.

The EU is the largest harvester of overfished yellowfin tuna in the region.

Blue Marine said its monitoring of EU-owned fishing vessel data in the Indian Ocean over four years showed the trend of “highly inconsistent” AIS use was continuing.

A report by Blue Marine and the intelligence company OceanMind found that, between January 2021 and August 2022, EU-owned tuna vessels spent more time “dark” than they did transmitting on AIS.

Every one of the 16 Spanish-flagged vessels that was monitored by Blue Marine spent a month “dark”, it said, with some spending 140 days with their AIS off.

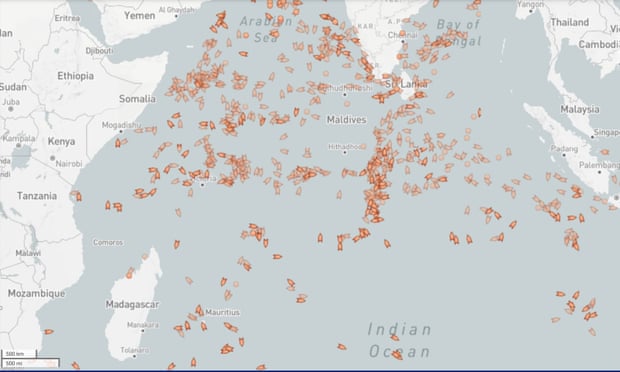

Traffic in a part of the Indian ocean of shipping vessels equipped with trackers, 13 February 2023.

Photograph: Marine Traffic (fishing vessels filter)

Photograph: Marine Traffic (fishing vessels filter)

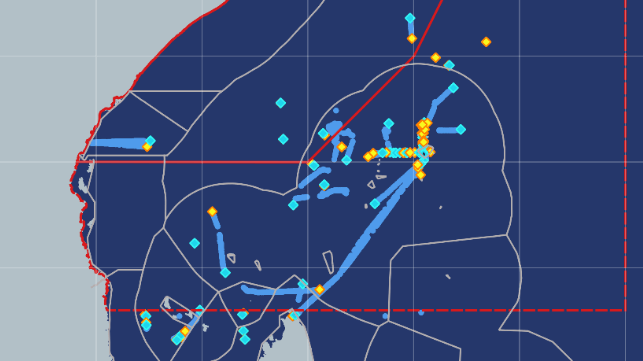

Start points (turquoise) and end points (yellow) for the AIS transmission gaps of one Spanish-owned tuna vessel, 2019-20.

Light blue lines show continuous AIS transmission, red line marks the then-current edge of the Somali HRA. (OceanMind / Blue Marine)

Legitimate reasons for a ship to “go dark” include to avoid detection in a high risk area, such as the one formerly around Somalia for piracy risk.

The recent OceanMind report, however, showed AIS gaps a significant distance from the former high-risk area, which has not existed since January, suggesting they are “highly unlikely” to be related to piracy.

Pablo Trueba, head of intelligence and compliance at OceanMind, said: “Unless you are within or really close to the high risk area for piracy, every other AIS switch-off is a risk indicator to avoid being observed and it could be to conduct unauthorised activities.”

The complaint to legal regulators argues that by continuing to insure vessels going dark in regions affected by sanctions, insurers are failing to follow industry guidance.

Kevin Shallow, director of underwriting for marine at QBE Europe, British Marine’s parent company, said: “Data has only recently been widely available to the industry in a way that gives detailed oversight and allows a more proactive stance in our response to AIS outage, and to deterring IUU (illegal, unreported and unregulated fishing).

“In collaboration with stakeholders across the fishing industry, including our own customers, we are working to improve safety, and identify those operators that do not meet appropriate standards.

In addition, our policy wordings have been strengthened to enable swift action through the withdrawal of coverage.

“However, we also have an obligation to act fairly to our customers and we recognise that there may be legitimate reasons the AIS transponder is turned off or is out of range.”

A spokesperson for MS Amlin said it had “clear controls” and “strict underwriting terms” that govern the actions and operations of any vessel the company insures.

“We do not insure vessels that fail to comply with international maritime laws, and it is made clear to our policyholders that those breaching maritime or indeed any international law, risk rendering their policy invalid,” the spokesperson said.

Britannia was approached for comment but did not respond.

Links :

- The Guardian : At least 6% of global fishing ‘probably illegal’ as ships turn off tracking devices

- Maritime Executive : NGO Files Complaint Against UK Insurers Over "Dark" Fishing Fleet

- Sciences Advances : Tracking elusive and shifting identities of the global fishing fleet

- Nature : Suspected illegal fishing revealed by ships’ tracking data

No comments:

Post a Comment